Learn

AFTERNOON TEA

Afternoon TEA: Biden Strangles Energy Independence

It’s a somber task to look back at the words we wrote just a week ago and regret that they were indeed correct. Our thoughts and prayers go out to the people of Ukraine as we hope for a safe and peaceful resolution for them to come soon.

Our guess is that many of you are wondering, what now? How will this affect our lives here at home when after the initial attack, crude oil prices exceeded $105/barrel for the first time since 2014? With the price per barrel of crude oil hovering just under the $100 mark for some time now, Americans were already paying nearly $1 more per gallon than they were a year ago and nearly $1.50 more than they were in 2020 before the pandemic and lockdowns took hold. So, how much higher can it get?

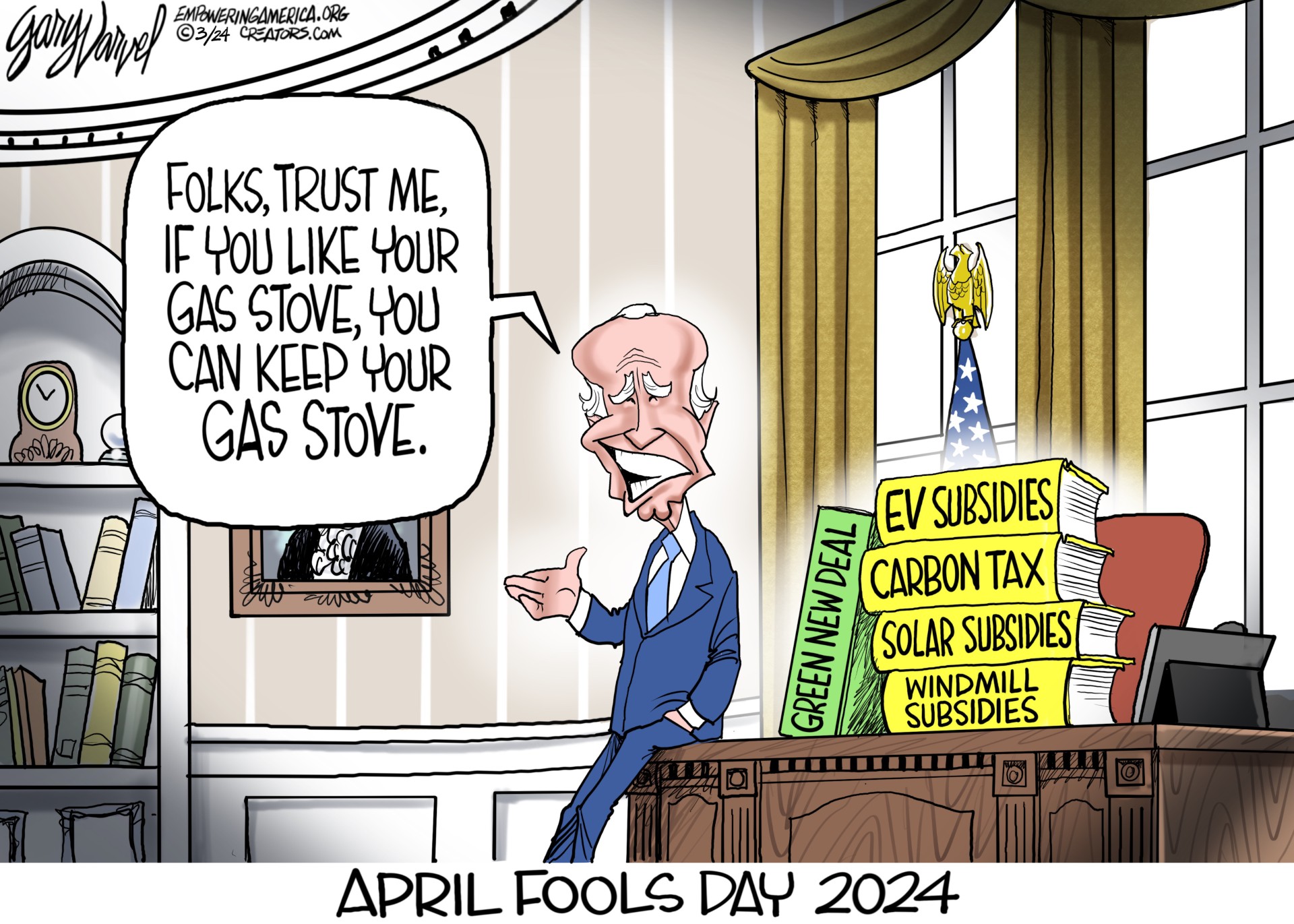

Well, certain analysts have said that crude oil prices could reach $120/barrel this summer and could go as high as $150/barrel in a worst-case scenario. Gasoline pump prices that we pay have four cost components: crude oil, refining, distribution, & Uncle Sam’s cut (tax). The first two make up about 70% of the cost while distribution is 14% and tax at 16% make up the rest. The important connection to be made here is the cost of crude oil and its refining is about 70% of what we pay out of our wallets. Thanks to President Biden’s war on American energy industry this cost has gone from $50 when America was energy independent in 2020, to now $100 and on its way to $150, when America is now dependent on Russian and foreign oil, again thanks to President Biden’s war on America’s energy industry and America’s energy independence.

Another common question we hear is, how big of a role do oil producers play in driving up the cost of oil? The short answer is none. Price is driven by market forces, public policy and major events like weather-related disasters or conflicts like the one we are seeing now in Ukraine. As our executive director Matt Hammond likes to say, oil and gas companies are price takers, not price makers. Yes, their profit increases as the price of crude increases, but if demand waivers as it always does when prices spike, then prices will come back down.

The moral of this story is, we can’t control so many of the things that effect what Americans have to pay at the pump. We can’t control an armed conflict on the other side of the world or the weather or the supply put out by foreign entities like OPEC. Which is why it is so important to take hold of what we can control—our own abundant energy resources and the policies and infrastructure that are necessary to get that energy to American families.