Learn

RESEARCH & DATA

TEA Factsheet – Taxing Energy

Biden’s Green-At-All-Costs Agenda Is Fueled By Taxpayer-Funded Subsidies

The primary argument in favor of building wind and solar infrastructure is that they receive substantial federal government support in the form of tax credits and state-level government support in the form of mandates. Whenever subsidies and mandates for wind and solar are threatened, development drops off rapidly. (Jason Hayes and Timothy G. Nash, “GRADING THE GRID: A National Energy Report Card,” Mackinac Center for Public Policy, 3/24)

- As billionaire investor Warren Buffet once said, “On wind energy, we get a tax credit if we build a lot of wind farms. That’s the only reason to build them. They don’t make sense without the tax credit.” (Nancy Pfotenhauer, “Big Wind’s Bogus Subsidies,” S. News and World Report, 5/12/14)

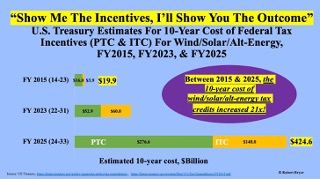

The alt-energy sector, including wind and solar, will collect a staggering $424.6 billion in tax credits over the next decade—an increase of 21 times what the credits were in 2015. “According to a March 11 report by the Office of Tax Analysis at the Treasury Department, the alt-energy sector will collect a staggering $424.6 billion over the next decade via the PTC [production tax credit] and ITC [investment tax credit]. The agency estimates that between 2024 and 2033, the PTC will cost taxpayers $276.6 billion, and the ITC will cost $148 billion. The PTC and ITC are the most expensive energy-related preferences in the tax code. (The 10-year cost of tax credits for “clean vehicles” comes in third, at an estimated cost of $112 billion.) Thus, since 2015, when Grassley (who has been in the U.S. Senate for 43 years) lauded the phaseout of the subsidies for wind energy, the tax credits for alt-energy haven’t decreased at all. Instead, they increased by a factor of 21!.” (“Wind/Solar/Alt-Energy Subsidies To Cost Federal Taxpayers $425 Billion Between Now And 2033,” Robert Bryce, 4/4/24)

(“Wind/Solar/Alt-Energy Subsidies To Cost Federal Taxpayers $425 Billion Between Now And 2033,” Robert Bryce, 4/4/24)

(“Wind/Solar/Alt-Energy Subsidies To Cost Federal Taxpayers $425 Billion Between Now And 2033,” Robert Bryce, 4/4/24)

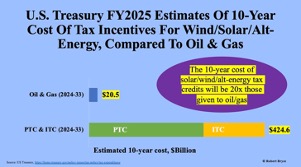

The production tax credit [PTC] and investment tax credit [ITC] received by energy sources like wind and solar are the most expensive energy-related preferences in the tax code, followed by the 10-year cost of tax credits for “clean vehicles” at third. “According to a March 11 report by the Office of Tax Analysis at the Treasury Department, the alt-energy sector will collect a staggering $424.6 billion over the next decade via the PTC and ITC. The agency estimates that between 2024 and 2033, the PTC will cost taxpayers $276.6 billion, and the ITC will cost $148 billion. The PTC and ITC are the most expensive energy-related preferences in the tax code. (The 10-year cost of tax credits for “clean vehicles” comes in third, at an estimated cost of $112 billion.)” (“Wind/Solar/Alt-Energy Subsidies To Cost Federal Taxpayers $425 Billion Between Now And 2033,” Robert Bryce, 4/4/24)

The 10-year cost of solar, wind and alt-energy tax credits will be 20 times the credits received by oil and gas. (“Wind/Solar/Alt-Energy Subsidies To Cost Federal Taxpayers $425 Billion Between Now And 2033,” Robert Bryce, 4/4/24)

(“Wind/Solar/Alt-Energy Subsidies To Cost Federal Taxpayers $425 Billion Between Now And 2033,” Robert Bryce, 4/4/24)

Oil and gas have received approximately 4% of total federal expenditures to produce 40% of primary energy demand. More than 90% of oil and gas subsidies can reasonably be described as costs of business or like research and development costs. (Jason Hayes and Timothy G. Nash, “GRADING THE GRID: A National Energy Report Card,” Mackinac Center for Public Policy, 3/24)

While subsidies given to wind and solar are targeted toward promoting the construction of current generation technologies, tax treatments and payments to nuclear and fossil fuels encourage research and specific aspects of exploration and development. (Jason Hayes and Timothy G. Nash, “GRADING THE GRID: A National Energy Report Card,” Mackinac Center for Public Policy, 3/24)

A Carbon Tax Means Higher Utility Bills And Higher Gas Prices For American Families

According to the Tax Policy Center, “A tax of $40 per ton would add about 36 cents to the price of a gallon of gasoline, for example, or about 2 cents to the average price of a kilowatt-hour of electricity.” “A carbon tax would increase the price of burning fossil fuels and any resulting goods or services. A tax of $40 per ton would add about 36 cents to the price of a gallon of gasoline, for example, or about 2 cents to the average price of a kilowatt-hour of electricity (Marron, Toder, and Austin 2015).” (“What is a carbon tax?,” The Tax Policy Center, Updated 1/24)

“Higher energy prices would raise costs for industry and households, resulting in lower profits, wages, and consumption.” (“What is a carbon tax?,” The Tax Policy Center, Updated 1/24)

“Because low-income households consume a more energy-intensive basket of goods than wealthier households do, a carbon tax would be regressive; it would cost poorer households a higher share of their income than wealthier households.” “Because low-income households consume a more energy-intensive basket of goods than do wealthier households, a carbon tax would be regressive; it would cost poorer households a higher share of their income than wealthier households (Rosenberg, Toder, and Lu 2018).” (“What is a carbon tax?,” The Tax Policy Center, Updated 1/24)

“For example, one carbon tax they consider would account for about 2.1 percent of pretax income for households in the lowest income quintile, as compared to 1.1 percent for the highest income quintile.” (“What is a carbon tax?,” The Tax Policy Center, Updated 1/24)

Biden’s Administration Has Taken Incremental Steps Toward A Carbon Tax

The Biden administration has expressed support for a carbon pricing or carbon tax mechanism. “‘We cannot solve the climate crisis without effective carbon pricing,’ Yellen said in response to a question about her views on an economy-wide price on carbon as an efficient mechanism to decrease emissions. ‘The President supports an enforcement mechanism that requires polluters to bear the full cost of the carbon pollution they are emitting. I am deeply engaged on this issue and, if confirmed, will continually discuss my views and thinking with the President and our entire team,’ she added. Yellen also affirmed support for sharing revenue raised through carbon pricing with American families to address the impact of moving toward a clean energy economy on lower-income households.” (Lisa Street, “UPDATE: US Senate confirms Janet Yellen as Treasury Secretary,” IHS Markit, 1/26/21)

Biden hiked the “social cost of carbon”—the way the U.S. government calculates the real-world cost of climate change—seven times higher than the number used by the Trump Administration. “President Biden on Friday dramatically altered the way the U.S. government calculates the real-world cost of climate change, a move that could reshape a range of consequential decisions, from whether to allow new coal leasing on federal land to what sort of steel is used in taxpayer-funded infrastructure projects. The administration plans to boost the figure it will use to assess the damage that greenhouse gas pollution inflicts on society to $51 per ton of carbon dioxide — a rate more than seven times higher than that used by former president Donald Trump’s administration. But the number, known as the “social cost of carbon,” could reach as high as $125 per ton once the administration conducts a more thorough analysis.” (Juliet Eilperin and Brady Dennis, “Biden is hiking the cost of carbon. It will change how the U.S. tackles global warming.,” The Washington Post, 2/26/21)

At the beginning of 2024, a fee included in Biden’s Inflation Reduction Act on certain methane emissions took effect—the first U.S. federal-level effort to price greenhouse gas emissions. “While a broad-based carbon tax is still only an idea in the United States, some incremental attempts at carbon pricing are more imminent. At the beginning of 2024, a fee on certain methane emissions took effect. While insignificant on its own, it is the first U.S. federal-level effort to price greenhouse gas emissions to combat climate change. The Inflation Reduction Act of 2022 largely rejected the Pigouvian taxation approach to solving climate change, which would make polluters internalize the social costs of pollution by applying an equivalent tax, instead opting to subsidize green energy production. However, the law accepts the taxation approach for certain methane emissions.” (Alex Muresianu, “Methane Fee to Take Effect in 2024: A Mini Carbon Price,” Tax Foundation, 1/2/24)

The Biden Administration Has Even Suggested Taxing Americans On The Number Of Miles They Drive

Pete Buttigieg, Biden’s Transportation Secretary, suggested a vehicle mileage tax “which would tax travelers based on the distance of the journey instead of on how much gasoline they consume.” “A vehicle mileage tax could be on the table in talks about how to finance the White House’s expected multi-trillion-dollar infrastructure proposal, according to Transportation Secretary Pete Buttigieg. Buttigieg, who spoke with CNBC’s Kayla Tausche on Friday, also contended that President Joe Biden’s forthcoming plans to rebuild the nation’s roads, bridges and waterways would lead to a net gain for the U.S. taxpayer and not a net outlay. ‘When you think about infrastructure, it’s a classic example of the kind of investment that has a return on that investment,’ he said. ‘That’s one of many reasons why we think this is so important. This is a jobs vision as much as it is an infrastructure vision, a climate vision and more.’ He also weighed in on several potential revenue-generating options to fund the project. He spoke fondly of a mileage levy, which would tax travelers based on the distance of the journey instead of on how much gasoline they consume.” (Thomas Franck, “Vehicle mileage tax could be on the table in infrastructure talks, Buttigieg says,” CNBC, 3/26/21)

Buttigieg: “A so-called vehicle-miles-traveled tax or mileage tax, whatever you want to call it, could be a way to do it … [a mileage tax] shows a lot of promise if we believe in that so-called user-pays principle: The idea that part of how we pay for roads is you pay based on how much you drive.” “‘A so-called vehicle-miles-traveled tax or mileage tax, whatever you want to call it, could be a way to do it,’ he said. Democrats have slowly pivoted away from a gasoline tax in favor of a mileage tax amid a simultaneous, climate friendly effort to encourage consumers to drive electric cars. ‘I’m hearing a lot of appetite to make sure that there are sustainable funding streams,’ the Transportation secretary said. A mileage tax ‘shows a lot of promise if we believe in that so-called user-pays principle: The idea that part of how we pay for roads is you pay based on how much you drive.’ He added: ‘You’re hearing a lot of ‘maybe’ here because all of these things need to be balanced and could be part of the mix.’” (Thomas Franck, “Vehicle mileage tax could be on the table in infrastructure talks, Buttigieg says,” CNBC, 3/26/21)

A mileage tax would hit low-income earners hardest: “While the average American spends roughly 13 percent of their income on transportation, that figure jumps to nearly 30 percent for the lowest-earning fifth of the population.” “In other words, it may take a while for the VMT tax to make it to prime time. And before it does, VMT proponents will have to reckon with significant equity concerns. Like the gas tax, and like sales taxes in general, a VMT tax would be regressive if applied uniformly across income brackets: It would take a larger percentage of income from low earners than it would take from high earners. That tracks with the way that transportation costs generally are unevenly distributed by income: While the average American spends roughly 13 percent of their income on transportation, that figure jumps to nearly 30 percent for the lowest-earning fifth of the population.” (Adam Mahoney, “Here’s why Pete Buttigieg’s tax on driving isn’t ready for prime time,” Grist, 3/30/21)

The tax would also disproportionately effect rural and urban communities where distances for services and commutes for workers are often much longer than average. “A VMT tax would also be likely to disadvantage rural communities, as well as communities of color generally. The former lack robust public transportation and also face long commutes to jobs and even essential services: A 2018 report found that rural communities commute nearly twice as long for hospital services compared to urban communities. And in urban areas, low-income workers and people of color frequently face a spatial mismatch between where they live and where jobs are located, making their commute times longer and access to public transportation spottier. A VMT tax could exacerbate this burden.” (Adam Mahoney, “Here’s why Pete Buttigieg’s tax on driving isn’t ready for prime time,” Grist, 3/30/21)